In recent years, researchers and practitioners in the behavioral sciences have profited from a growing literature on delay discounting. The purpose of this article is to provide readers with a brief tutorial on how to use Microsoft Office Excel 2010 and Excel for Mac 2011 to analyze discounting data to yield parameters for both the hyperbolic discounting model and area under the curve. This tutorial is intended to encourage the quantitative analysis of behavior in both research and applied settings by readers with relatively little formal training in nonlinear regression. The goal of this technical article is to present researchers with a tutorial on how to conduct both nonlinear regression and area under the curve (AUC) estimations using Microsoft Office Excel 2010 and Excel for Mac 2011 (hereafter referred to simply as Excel) to analyze delay-discounting data. Analyses of delay discounting (the process by which delayed rewards have lower subjective values than sooner rewards of the same magnitude) have become increasingly popular due to their ability to allow researchers to investigate the temporal properties of reward for socially important problems (see; ).

Specifically, this operationalization of decision making is translated easily to issues concerning impulsivity and self-control. For instance, behavior analysts have come to define a form of impulsivity as preference for a smaller sooner reward, despite a larger delayed alternative being available (see ). This behavioral interpretation of impulsivity has led to numerous advances in clinical issues such as increasing tolerance to reinforcement delay in individuals with acquired brain injury or autism (; ), as well as in the general assessment of impulsivity in children with attention deficit hyperactivity disorder (ADHD;; ), serious emotional disturbance (e.g., ), and severe problem behaviors (e.g., ).

Collecting Discounting Data The commonly used procedure for studying discounting is the administration of a series of hypothetical monetary choice trials (see; ). Typically, hypothetical monetary choice paradigms feature a titrating series of choices between smaller sooner rewards (SSRs) and a larger later reward (LLR). The point at which an individual switches from choosing the LLR to the SSR is commonly termed the indifference point. This indifference point serves as an estimation of the subjective value of the LLR after some delay. This methodology then is replicated across numerous delay values (i.e., the delay until the receipt of the LLR) to arrive at an understanding of the individual's preference for reward over time (the reader is encouraged to consult, for a lengthier discussion on discounting assessment methodology).

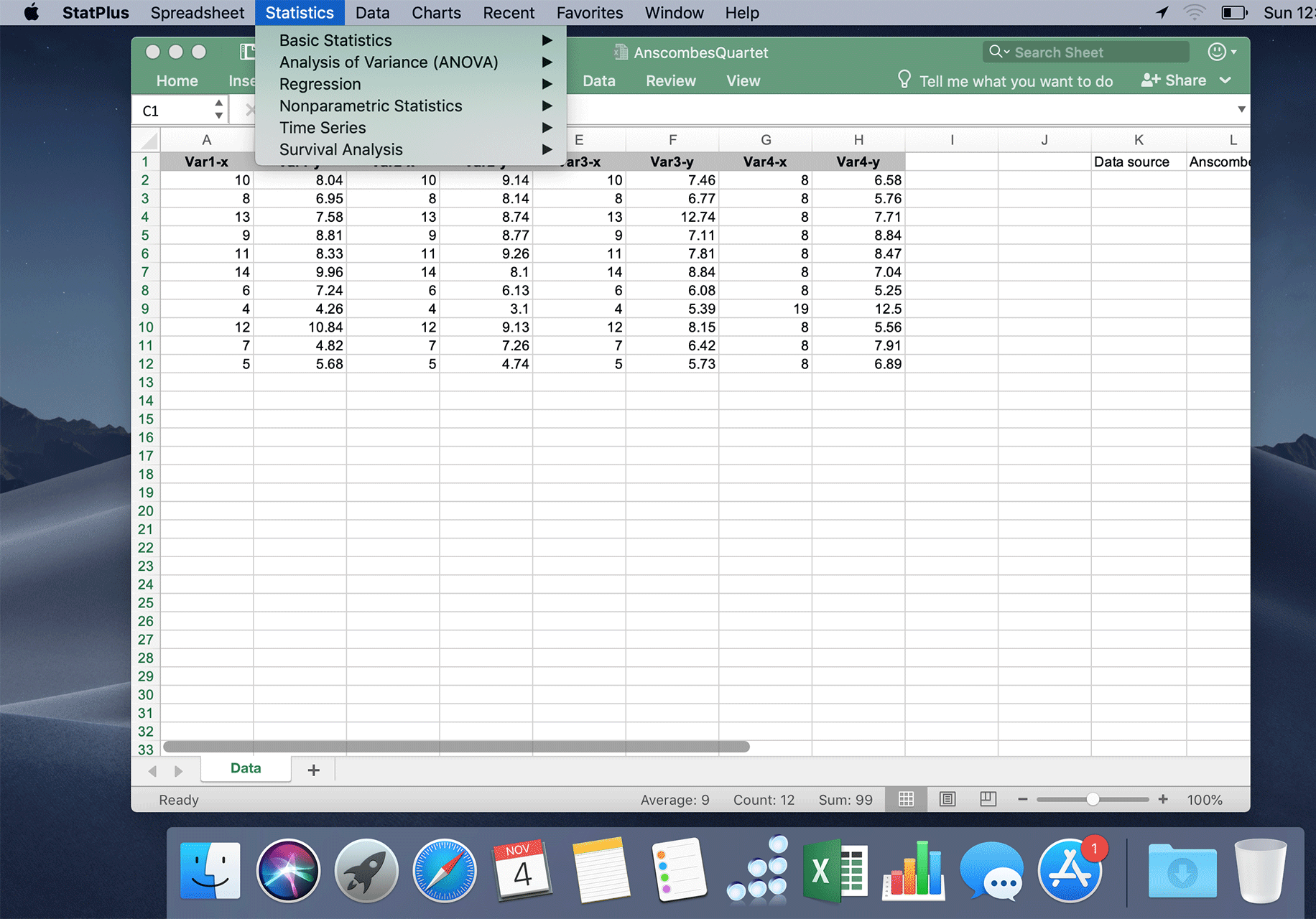

.using excel regression analysis, however the tutorial they have is for a much older version, and so far I haven't been able to find a useful tutorial for 2011. Menu text for machine shed. I have the following Excel VBA script which I use in Excel for Mac 2011 to export all the worksheets of an Excel file to.csv files. Sub save_all_csv. To run regression analysis in Microsoft Excel, follow these instructions. Excel for Mac 2011 and higher do not include the analysis tool pack.